Features

Business

Cultivation

Management

Production

One year after legalization, market anticipates Cannabis 2.0

October 15, 2019 By Mari-Len De Guzman

Photo: Adobe Stock

Photo: Adobe Stock This week marks not only the first year that recreational cannabis has been legal in Canada, but the official legalization of Cannabis 2.0 – which would make available the much-awaited cannabis extract products through edibles and topicals – both happening on Oct. 17th.

Here’s a review of year one of cannabis legalization and a look at market trends over the next year against the backdrop of Cannabis 2.0.

Hype versus reality – The first few month after the federal government declared the recreational cannabis market officially open was marred with market disappointments and dissatisfaction, as wide-spread product shortages across the country left consumers scratching their heads. It was not like the market did not anticipate the demand for products once legalization hit. Months before the official legal market opening, licensed producers were ramping up production to meet the anticipated demand, building massive infrastructures to support large-scale grow facilities.

Several factors played a key role in the roll-out flop – delayed retail store openings, backlog in production licence issuance by Health Canada, the logistical challenges of getting products to the frontline stores, some licensed retail outlets forced to close shop after struggling to put products on their shelves.

As a result, sales forecasts were found wanting. Months before legalization, Toronto-based Deloitte estimated legal sales to reach more than $4 billion in 2019. However, according to Statistics Canada, sales of legal cannabis was only at $524 million during the first seven months of 2019 – not even half of the projected sales for the year.

The fact that the grey market is still selling at a relatively lower price per gram of cannabis than the legal route has remained a challenge as well. The average price of illicit pot is $5.59 per gram – almost half of the price of legal cannabis which is currently at $10. 23 per gram, according to Statistics Canada. Although prices in the legal market has declined in the third quarter of the year, so has the illegal market.

Economic impact – Despite the initial hiccups, the cannabis industry fulfilled its promise of significantly contributing to the Canadian economy. Statistics Canada reported that the cannabis industry added $8.26 billion to the GDP as of July 2019. The industry also grew by 185 per cent in the first 10 months since legalization. Employment in the cannabis industry increased nearly four times over the past year from 2,630 workers in 2018 to 9,200 to date.

Revenue reports – Earnings reports from major Canadian cannabis companies have been less than impressive. Industry observers have attributed the losses to the massive capital expenditures over the last year as companies push to complete their infrastructure project plans, building thousands of square feet of cultivation, production and extraction spaces. The downtrend is expected to turn around as companies begin to reap the rewards of their capital investments moving forward and start to realize some gains from their foray into the global marketplace.

Speaking at this year’s MJBizCon International conference in Toronto, Canopy Growth CEO Mark Zekulin said his company is now transitioning “from builders to operators,” expecting company profitability within three to five years.

After months of lower than expected revenue reports from the big cannabis companies, some producers are starting to see some earnings growth. Most recently, Aphria has announced a profit of $16.4 million during the latest quarter of its fiscal year ending August 31st, the company’s second consecutive quarter of profitable growth. The news sent Aphria’s shares spiking 22 per cent – a significant win for the market after an overall declining trend in share prices for the cannabis sector over the past few months.

Outdoor growth – This year, Health Canada issued several licences that gave cannabis producers the green light to start producing cannabis outdoors. Growing cannabis outdoors offers great potential for sustainable, low-cost production that is destined to primarily serve the extracts market.

With outdoor grow “we are talking about acres and tonnage not square footage,” remarked Taylor Carr, cultivation and horticulture manager at WeedMD RX, at a panel session debating the merits of indoor and outdoor grow held at this year’s Grow Up Conference in Niagara Falls last September. WeedMD is complementing its 610,000 square feet of greenhouse facility with an expanded 27-acre outdoor cannabis cultivation farm in Strathroy, Ont.

This fall will see the first crop of harvest from outdoor cannabis farms. One of the first producers to receive an outdoor grow licence from Health Canada, 48North, is currently harvesting its very first batch of cannabis from the company’s 100-acre farm in Brant County, Ontario. WeedMD is also expected to harvest its first outdoor crop this fall.

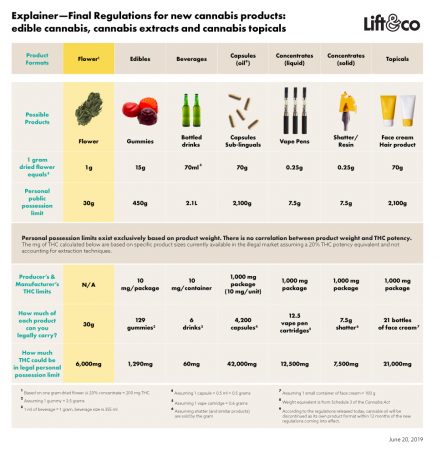

Edibles and extracts – The biggest news that will mark the one year anniversary of cannabis legalization is Cannabis 2.0. Deloitte expects the Canadian market for edibles and alternative cannabis products to be worth $2.7 billion annually. An estimated one in four Canadians will be consuming or likely to consume cannabis edibles and extracted products, Deloitte says this brand new legal market stands to create new growth opportunities for Canada’s cannabis sector.

“The new options will address consumer interest among current and likely Canadian cannabis consumers,” Deloitte said in its report, Nurturing Growth: Canada gets ready for Cannabis 2.0.

In its separate report, EY Canada and Lift & Co. estimated that as many as three million new consumers who are not interested in dried cannabis products, may be more receptive to the cannabis market when new, alternative cannabis products are introduced this year. More than two million of that estimate are potential new consumers for topical products, and about 1.5 million will be edible consumers.

“New product offerings will open the doors for experimentation among current and non-consumers, giving cannabis companies the opportunity to capture a larger market share,” said Monica Chadha, EY Canada Cannabis Leader, in an earlier statement. “But companies should keep in mind that these consumer segments will have very different attitudes towards cannabis and product formats, ultimately driving the need for differentiated customer experiences.”

Print this page