Features

Business

Export

International

Beyond borders: why Canadian LPs must enter international markets

June 22, 2023 By Steve Clark

World map made from dry cannabis. Photo: Adobe Stock

World map made from dry cannabis. Photo: Adobe Stock As I stepped into the Canadian cannabis industry in early 2018 as a seasoned commodity professional, it didn’t take me long to realize that this was not an industry for the faint of heart.

Regulated cannabis is a market that demands financial prudence, lean operations, and a hyper-focus on executing corporate strategies. The uncertainty of a new emerging market was expected, but I don’t think anyone foresaw that the Canadian market would get stuck in second gear while the world caught up and eroded our first mover advantage.

Canadian industry experts such as Dan Sutton, Myrna Gillis, George Smitherman, Nathan Mison, and many others continue to advocate for regulatory changes required for a sustainable domestic cannabis industry. Despite these challenges, caused by numerous factors, there are still select licensed producers/processors (LPs) that have been able to succeed in domestic and international markets.

With the global cannabis landscape rapidly evolving, LPs must broaden their global reach to tap into higher-priced markets to ensure their survival.

Now, as Canada’s cannabis industry approaches its fifth year of legalization, there is a growing urgency to expand internationally and capture new markets. The good news is that many Canadian LPs are already exploring international opportunities and helping to develop this emerging market.

According to a recent survey conducted by the Canadian Cannabis Exchange (CCX), 10 per cent of Canadian LPs are exporting cannabis products to other countries and 40 per cent plan to make exporting part of their marketing mix. Germany, Australia, Israel, and the United Kingdom are the top destinations from the survey. The development of new supply channels to international markets led by LPs, consultants, and brokers/exchanges is a significant boost to the cannabis industry.

What is required to advance?

Canadian LPs face regulatory hurdles when expanding into international markets. They must comply with the regulatory frameworks in the target markets, including obtaining import and export permits, and meeting international standards such as GPP, GMP, EU-GMP, GACP, and CUMCS-G.A.P., IMC-G.A.P.

These licensing standards are stringent and cover all aspects of cannabis cultivation, processing, packaging, and distribution. There are many Canadian LPs holding these types of licenses and even more who are nearing a range of certifications.

However, obtaining certification is not easy and involves significant costs, reporting, inspections, third-party audits, and recertifications. Given that the global cannabis market is projected to grow to $73.6 billion by 2027, with medical cannabis driving the majority of growth, entering this channel is crucial for producers.

Germany

In Germany, strict quality standards for the production, import, and distribution of medical cannabis are enforced by the Federal Institute for Drugs and Medical Devices (BfArM). To deliver medical cannabis to this country, Canadian LPs must meet the BfArM’s standards, have a valid Health Canada issued export permit, an EU-GMP certified product, as well as a corresponding German import permit.

Announcements of the recreational cannabis framework are still pending but reports in early April 2023 indicate the delay of nationwide adult-use sales in Germany’s reported two-phase approach to legalization. This may impact Canadian cannabis companies looking to export into Germany. The companies that were preparing for a free-market model, with increased national distribution, may have to wait until the second phase to see the expected market growth. However, the first phase, including home cultivation and non-commercial cannabis clubs, still presents opportunities for Canadian companies to establish themselves in the medical German market as they achieve EU-GMP certification.

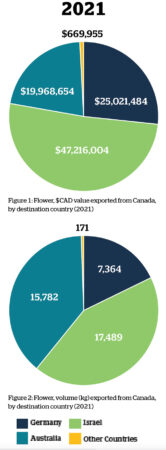

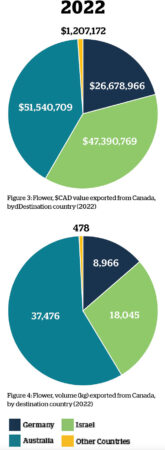

In 2022, Germany witnessed a significant increase in the importation of medical cannabis, and Canada accounted for 8,966 kilograms of dried flower imports. Overall, according to recent statistics published by the BfArM, nearly 25,000 kilograms (27.6 tons) of cannabis was imported, which represents a 19 per cent increase compared to the 20,769 kilograms imported in 2021. This was the slowest growth since 2018 and doesn’t account for a re-export of product to other medical European markets.

According to pharmaceutical data provider Insight Health, cannabis extracts witnessed the most rapid growth among all categories in the German market, constituting roughly 26 per cent of the market share in October 2022 – a marked increase of 21 per cent from the preceding year. These values underscore the importance of developing medical distribution channels, exploring other European countries, and fulfilling multiple product categories.

Israel

The Israeli cannabis regulator IMCA was formed in 2013 in response to the first government resolution to control the cannabis industry, which was passed in 2011. The Israeli cannabis industry has been rapidly evolving in recent years, with the country becoming a leading option for Canadian cannabis exports (18,045 kg in 2022).

To import cannabis into Israel, companies must hold an IMC-GMP or equivalent CUMCS certification issued by the Israeli Ministry of Health’s Medical Cannabis Unit. This certification ensures that the cannabis meets strict quality and safety standards, including testing for heavy metals, pesticides, and other contaminants.

To date, Canada has seen limited price compression for cannabis exporting into Israel as the market has grown in similar size compared to the newly licensed CUMCS production. Expect to see, in early 2024, the global supply of Israeli certified product catch up with the growth in the Israeli market. And similar to Germany, re-export to neighboring countries could also be a viable opportunity for the country.

Germany and Israel are just two of the international export opportunities present today for Canadian cultivators. Growing demand for cannabis worldwide presents a significant opportunity for Canadian LPs to expand into international markets. Tapping CCX’s connections, industry consultants, or the newly formed Global Cannabis Trade Association (GCTA), can substantially open doors to new distribution and revenue channels.

I also believe the government should provide financial support to Canadian cannabis LPs in obtaining these international certifications. Canadian companies are competing together against low-cost supply from countries such as Colombia, South Africa, and many other emerging markets. Government assistance would not only promote Canada’s reputation, once again highlighting Canadian cannabis on the world stage, but it would also benefit all those involved.

Steve Clark is regarded for his expertise in business development. He co-founded Canadian LP 314 Pure and advises on multiple industry boards. Steve’s innovative drive is the force behind CCX’s success, where he currently serves as founder and CEO.

Print this page